Microfinance can be defined as a type of banking service that is provided by Micro Finance Institutions to unemployed or low-income individuals or groups who do not have access to financial services. It allows people to take on small business loans safely in a manner that is consistent with ethical lending practices. Although micro financing operations exist throughout the globe, the majority of such operations occur in developing nations like Uganda, Indonesia, Serbia, and Honduras.

Table of Contents

Types of Microfinance

Microfinance can be divided into three types:

- Microloans: Microloans are consequential because these loans are provided to borrowers with no collateral. The desired result of microfinance loans is to have its beneficiaries outgrow smaller loans and be ready for traditional bank loans.

- Micro savings: Micro savings accounts enable entrepreneurs to operate savings accounts with no minimum balance. These accounts enable users in fostering financial discipline so that they develop an interest in saving for the future.

- Microinsurance: This is a type of insurance coverage that is provided to the borrowers of microloans. These insurance plans have comparatively lower premiums than traditional insurance policies.

How Microfinance Works

Micro financing organizations support a large number of financial activities like bank checking and savings account management for providing startup capital for small business entrepreneurs and educational programs that teach the principles of investing. These programs mostly focus on skills like bookkeeping, cash-flow management, and technical and professional skills like accounting. In various instances, people seeking help from microfinance institutions are first required to take a basic money-management class where they are taught the concepts of cash-flow, interest rates, how financial agreements and savings accounts work, managing debt, etc.

Unlike traditional financing institutions, where the lender is mostly concerned with the borrower having enough collateral to cover the loan, many micro financing institutions focus on helping entrepreneurs succeed.

History of Microfinance

The operations of microfinance institutions can be traced back to the 18th century. The first occurrence of microlending is attributed to the Irish Loan Fund system that was introduced by Jonathan Swift and was aimed at improving conditions for poor Irish citizens.

Micro financing became quite popular on a large scale in the 1970s. The first organization to receive attention was the Grameen Bank which was established by Muhammad Yunus in 1976 in Bangladesh. Besides providing loans, the Bank also suggests its customers adhere to its ‘16 Decisions’ that state basic ways for helping the poor in improving their lives.

Established in 1998, India’s SKS Microfinance has grown to become one of the biggest microfinance operations in the world. It works in similar ways to the Grameen Bank, pooling borrowers into groups of five members and working together to make sure that their loans get repaid.

There are several microfinancing institutions around the world. Some larger institutions work closely with the World Bank while other smaller groups operate in different nations.

Common Objectives of Microfinance Institutions (MFIs)

- Microfinancing institutions provide financial services to the poor for viable productive income generation enterprises, which in turn helps them reduce their poverty.

- They assist underprivileged people in starting their business by providing them with microcredit loans.

- Microcredit gives impoverished people protection from sudden financial problems that could otherwise have devastating effects on their financial and business situations. Microinsurance provides people with the ability to pay for health care so that they can receive proper treatment for health conditions before they become serious.

- Women make up a large proportion of microfinance recipients. Microfinance provides women with the financial support they need to start business ventures. It gives them confidence, improves their status, and makes them more active in decision-making.

- Microfinance institutions seek to reduce poverty throughout the globe. The funds and services from MFIs give hope to people who previously did not have much opportunity to become self-sufficient. New business ventures provide jobs that increase income among community members and improve their overall well being.

The For-Profit Controversy

Although microfinance rates are usually lower than traditional banks, critics have presented accusations that these operations have, in some cases, been used for making money off of the poor, especially since the trend of for-profit microfinance institutions like BancoSol in Bolivia came into the limelight.

One of the most controversial cases is Mexico’s, Compartamos Branco. The bank started in 1990 as a non-profit organization. However, 10 years later the management decided to transform it into a traditional, for-profit company. The main difference between the for-profit and non-profit companies lies in how they use the funds they gather in interests and repayments. The for-profit companies distribute them to their shareholders while the non-profit institutions use the profits to increase the number of people they help or create more programs. Other than Compartamos Banco, several major financial institutions have launched for-profit microfinance departments like CitiGroup, Barclays, General Electric, etc.

These for-profit institutions have been criticized by many including, the grandfather of modern microfinance, Muhammad Yunus. According to them, the incentive for microcredit should be poverty alleviation and not profit. But the for-profit micro financiers argue that by becoming a profitable business, a microfinance bank can extend its reach and provide more money and loans to low-income applicants.

Microfinance Loan Terms

Like traditional lenders, micro financiers also charge interest on loans. They generate specific repayment plans with payments due at regular intervals. Some lenders require loan beneficiaries to set aside a part of their income in a savings account that can be used as insurance if the customer defaults. Since many loan applicants cannot offer collateral, micro lenders often gather borrowers together and put them into groups. After receiving loans, recipients repay their debts together. For example, if an individual has trouble using his or her money to start a business, that individual can ask for help from other group members or the loan officer. Through repayment, these recipients start to develop a good credit history that enables them to obtain larger loans in the future.

Although these borrowers are very poor, repayment amounts on micro loans are often higher than the average repayment rate on more conventional forms of financing.

Benefits of Microfinance

According to the reports of the World Bank, more than 500 million people have directly or indirectly benefited from microfinance-related operations. Other than providing micro financing operations, the International Finance Corporation (IFC), part of the larger World Bank Group, has helped establish or improve credit-reporting bureaus in 30 developing nations. It has also proposed for adding relevant laws in 33 countries that govern financial activities.

The benefits of microfinance extend beyond the direct effects of giving borrowers a source of capital. Entrepreneurs who start successful business ventures, in turn, create jobs, trade, and overall economic development within the community.

Where can I get micro financing?

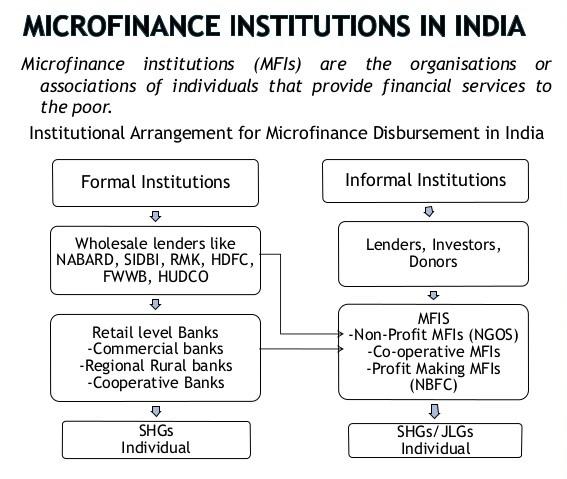

Micro financing services are offered by the following institutions:

- Formal institutions like cooperatives and rural banks

- Semiformal institutions like non-government organizations

- Informal sources like shopkeepers and small-scale lenders

The different types of institutions that offer microfinance in India are:

- Commercial banks

- Credit unions

- Non-Governmental Organizations (NGOs)

- Sectors of government banks

- Cooperatives

How to get approved for micro financing?

- Write a business plan

Lenders want to see whether you take your business seriously and have a plan as they want to work with people who are likely to succeed in the future. A successful business plan includes a company overview, introduction, mission statement, market and industry analysis, marketing plan, and operations plan.

- Have decent credit

Having a decent credit score makes an excellent impression. Review your report carefully and make sure that it does not have any false information.

- Secure the deal with a personal guarantee or collateral

Your guarantee is your legal promise to repay the loan. Collateral, like your house, is something that the lenders can use against you if you don’t repeat it. If you are confident that your business venture would be successful then offering these two things will help you to get a loan.

- Invest some of your own money

When a business owner puts his or her investment into their company along with a microloan, it shows that they are serious and will ensure that their business becomes successful soon.

Micro Finance Models in India

The Micro Finance Models in India are a mixture of traditional and innovative methods and cater to a large proportion of the people who are having difficulties in accessing credit in India. One of the common models is the Grameen model that is based on the successful model in Bangladesh.

In a self-help group model, there are around 5-20 group members. The groups are formed based on the common interests that lead to common goals. It is seen that most of these groups are made up of women and lay the path towards women empowerment. The NGOs operate within the self-help group model.

There are also government-sponsored microfinance initiatives like the National Bank for Agricultural and Rural Development (NABARD).

Microfinance Channels

Microfinance in India operates via two channels:

- SHG-Bank Linkage Program (SBLP): This channel was launched by NABARD in 1992. It encourages financially backward women to come together and form groups of 10-15 members. They contribute their savings to the group at frequent intervals and loans are provided to the members of the group from these contributions.

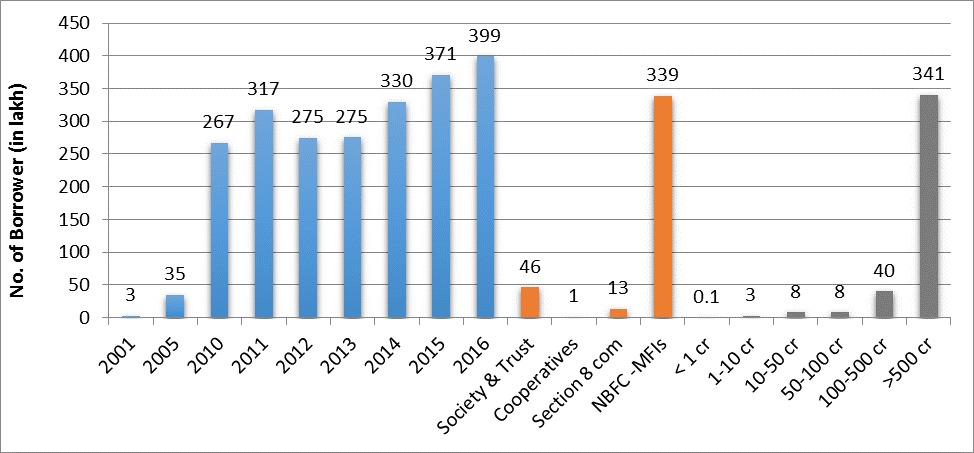

- Microfinance Institutions (MFIs): These institutions have microfinance as their primary operation. They lend through the concept of Joint Liability Group (JLG) that is an informal group of 5-10 members who seek loans either jointly or individually.

Microfinance Companies in India

The top 10 microfinance companies in India that offer loans to the unbanked and under-banked population in India are:

- Arohan Financial Services Pvt Ltd

- BSS Microfinance Pvt Ltd

- Cashpor Micro Credit

- Equitas Microfinance Pvt Ltd

- Asirvad Microfinance Pvt Ltd

- Bandhan Financial Services Pvt Ltd

- Disha Microfin Pvt Ltd

- Annapurna Microfinance Pvt Ltd

- ESAF Microfinance and Investments Pvt Ltd

- Fusion Microfinance Pvt Ltd

What are the different types of loans that are given through Microfinance companies?

The types of loans given by microfinance companies include:

- Loans for women to increase their income generation

- Loans for homegrown entrepreneurs

- Emergency medical loans

- Home improvement loans

- Home extensions/ business improvement loans

How Microfinance Companies give loans to borrowers?

Microfinance Companies provide loans to people who did not have access to credit previously. However, there are some risks involved that need to be factored by the MFIs.

Once the skills, purpose, and the educational qualifications of the borrower are ascertained by a representative of the microfinance organization. They draw up an agreement that contains the terms during the loan period. There is another group that takes part in the maintenance and recollection of the loan. If the borrower has special skills like weaving or handcrafting, the microfinance institutions might treat it differently.

It has also been noticed that besides giving loans to the people of the rural sectors, the MFIs are giving loans to the urban poor.

Eligibility criteria for availing microfinance loans

- Should have the ability to work

- Must be a permanent resident of his/her area/village.

- Should be below the poverty line

- Should not be a defaulter of any organization

- Should meet the eligibility criteria advocated by the Reserve Bank of India (RBI) and Microfinance Institutions Network (MFIN) like house indebtedness, household annual income, etc.

Documents Required for a Microfinance Loan

- Updated application form

- PAN Card, copy of Passport, ration card

- Passport-size Photos of the applicants and co-applicants

- Proof of office address

- Certified copies of AOA/MOA/Partnership deed

- Track record of repayment

- Audited financials of the last 2 years

- ITR of partners/directors for the previous 2 years

- Bank account statements for the past 6 months

- Proforma invoice to the equipment that needs to be financed

- Professional qualification certificates for lawyers, CAs, architects, and doctors.

Microfinance and Credit Score

While most microfinance institutions lend to those people who might not have a credit score, there is a huge opportunity for the target groups of being inducted into the credit system by opening a bank and eventually a loan account which in turn helps in the building of a credit score. Getting into the credit system is the only way a true financial inclusion is possible. This is still in its early stages with initiatives like the ‘Jan Dhan Yojana’. There is no doubt regarding the importance of microfinance organizations in getting more people to experience credit.

Differences between Microcredit and Microfinance

- Microcredit is a small loan facility provided to the people with less earning that motivates them to become self-employed whereas Microfinance refers to financial services provided to the small business entrepreneurs or enterprises who cannot avail the services of banks for banking or other financial facilities.

- Microcredit is a small loan that is provided at a low-interest rate to the persons below the poverty line so that they can become self-employed whereas microfinance means the broad spectrum of financial services like loans, insurance, and savings that is provided to the individuals of low-income group.

- Microcredit only includes credit activities whereas Microfinance includes credit as well as non-credit activities like savings, pension, insurance, etc,

- Micro credits are small size loans with shorter repayment periods and are granted for small-scale activities that direct to serve local needs whereas Microfinance services help low-income individuals and start-ups in developing countries to start running a small business, increase assets, diminish risks, raise productivity, increase return on investments, increase income, and eventually increase welfare.

Why are the interest rates of microfinance institutions higher than the traditional banks?

- Microfinance institutions carry out their transactions in cash and have to frequently travel to collect money that results in high operational costs. Traditional banks do not have to bear these costs.

- Most microfinance institutions require private equity to raise capital as they are not allowed to collect savings like traditional banks as a way to fund loans. Hence, the microfinance institutions have a responsibility to provide their investors with an adequate return on investment.

- Another reason why the interest rates are high in microfinance institutions is that they borrow from banks with interest rates ranging from 12 percent to 15 percent and then spends around 10 percent to cover the high costs, 5 percent to protect against high risks of default, 2-5 percent for supplemental support products like insurance, and 5-10 percent for returns for investors.

Salient features of Microfinance in the USA

The microfinance institutions developed in the United States during the 1980s to serve the low-income and marginalized minority communities.

Some of the features of Microfinance in the USA are:

- The borrowers are usually from low-income backgrounds

- The purpose of the loan is income generation

- The focus is on economic development and job creation at the macro level.